$SUGR.V on September 30, 2024

Stock Price: $8.40 (CAD)

Market Cap: $146M (USD)

SUMMARY

Capacity expansion into American and Canadian refining industries operating at a deficit to demand.

Modern technology, logistical innovation, and strategic positioning offer edges in efficiency and flexibility.

A strong, proven management team with 76.6% insider ownership and a history of disciplined capital management.

Trading below book value (0.88x).

If management can achieve the production goal they have outlined for 2029, I anticipate the company being worth approximately 5x the current price in 5 years (38% CAGR). Failure to meet production targets by the specified dates still offers significant upside.

PREFACE

I expect many of you were first introduced to me through Moberg. If that is you, thank you for coming back. If not, then welcome. This pitch will be quite different, hopefully for the best. Due to the present illiquidity of the name, I will not be discussing it too much publicly until liquidity improves.

To get the most out of your reading, please review the resources linked in the text. Bolded text should be noted as key points. As always, please don’t take what I say for granted; earn your conviction.

INTRODUCTION

Sucro Ltd. ($SUGR.V) is an integrated sugar refiner serving primarily the United States and Canada. The company was founded in 2014 by current CEO Jonathan Taylor with a vision to disrupt the industry. Jonathan came up as a sugar trader, and in the last 10 years, he has built a $400M enterprise with sugar trading, refining, and distribution arms. Sucro boasts an impressive executive team and Board of Directors of industry veterans with 76.6% insider ownership (68% held by the CEO).

Sucro is a young, ambitious company moving quickly to take advantage of complacent incumbents by constructing capital-efficient refineries that utilize more efficient and flexible systems designed with value-added capabilities. Sucro can provide custom solutions and value-added options that legacy refiners cannot accommodate. Their strategically located facilities give Sucro logistical and cost advantages over competitors.

Sucro is the first in North America to:

Build a micro-refinery (a la Nucor)

Refine imported organic sugar (currently the market leader in organic in the U.S.)

Utilize bulk ocean vessels to ship organic sugar

THE CATALYST: REFINERY CONSTRUCTION

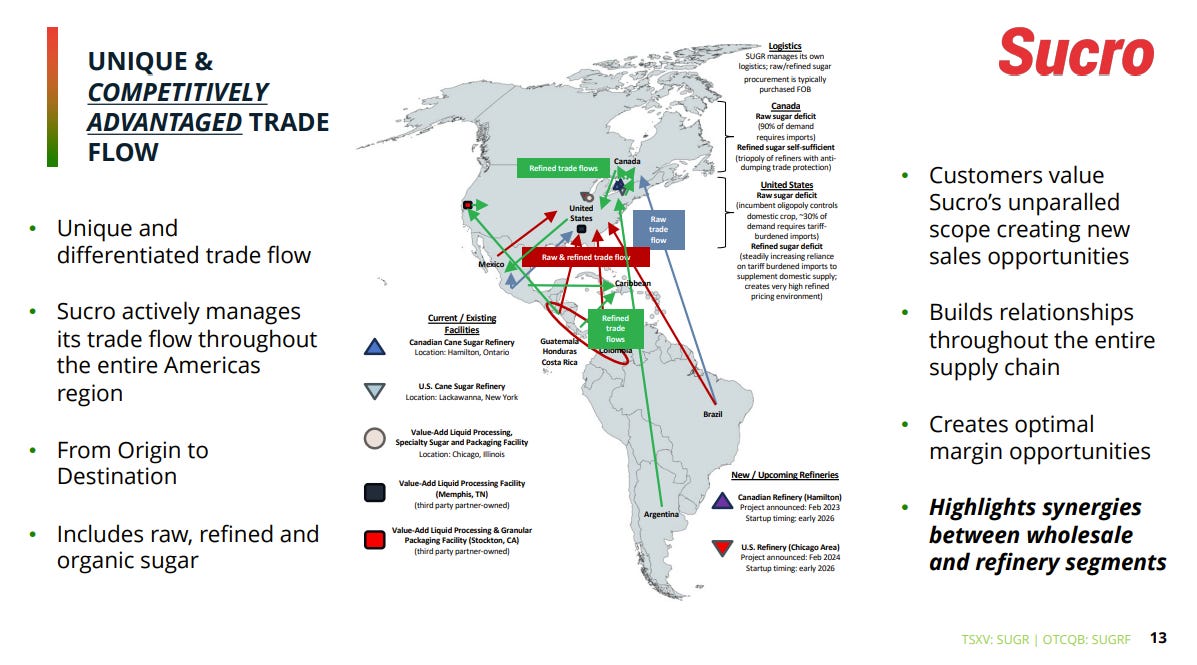

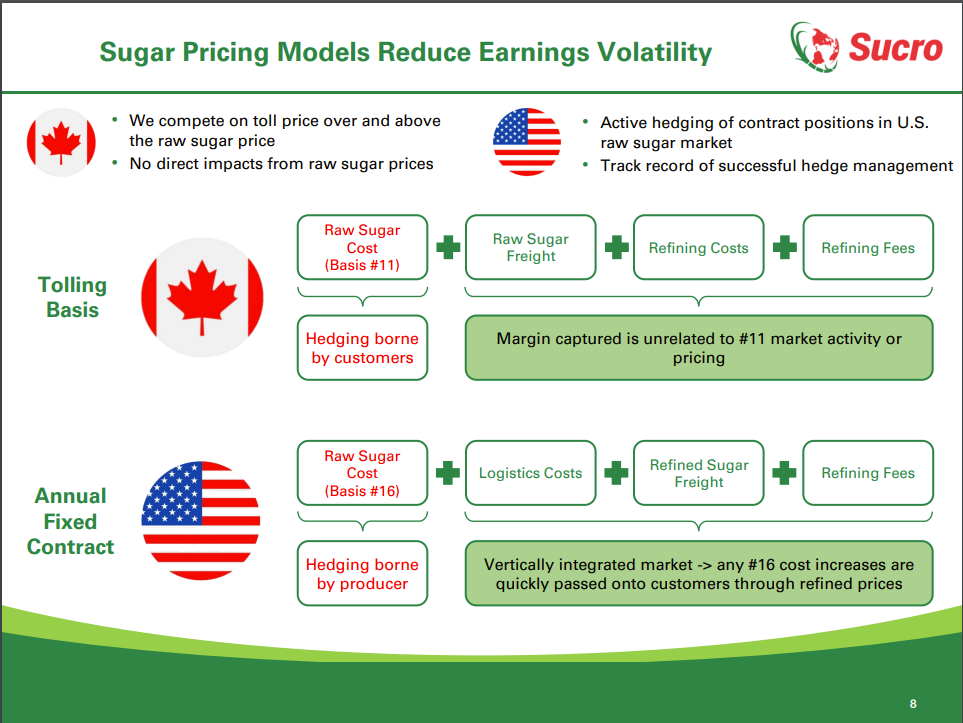

Sucro’s growth revolves around refining capacity expansion and margin improvement from the transition away, proportionally, from the lower-margin trading business. The networks and relationships formed in that business will have synergistic effects as they can sell their own refined product into those channels.

The three refinery sites are strategically located close to customers and with full logistics capabilities (access to rail, truck, and ship). This allows cheaper and more flexible importation of raw sugar via bulk shipping vessels and the efficient transfer of refined sugar to land routes for delivery, keeping costs and complexity to a minimum.

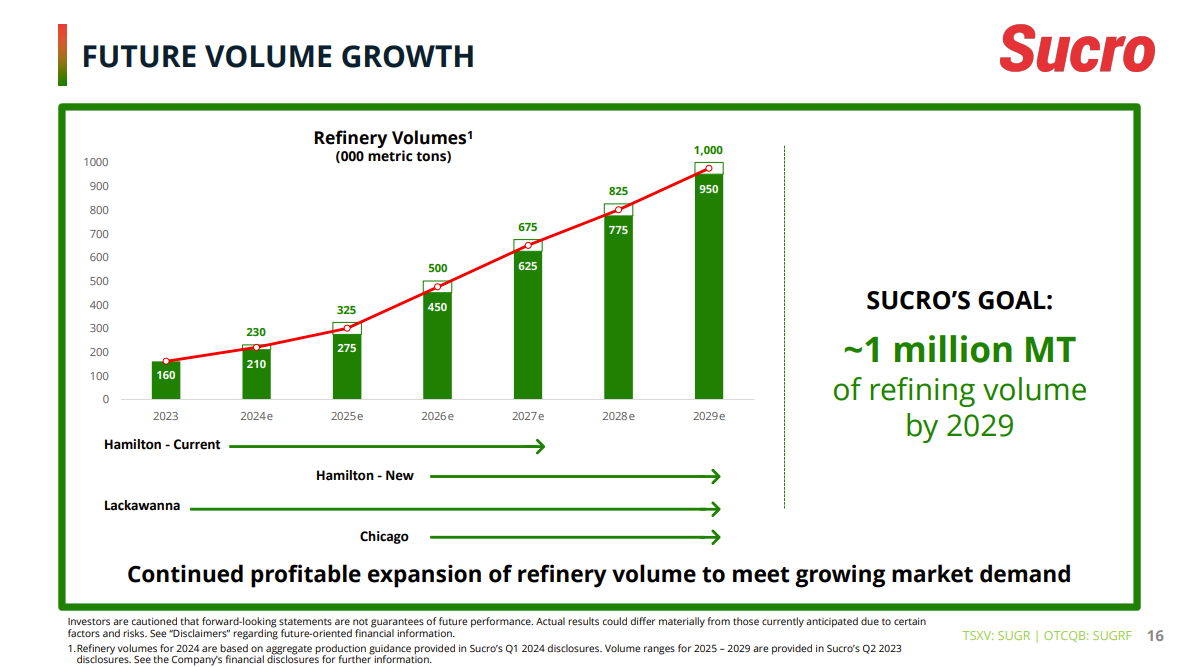

Sucro currently has about 210,000 metric tonnes (MT) of annual refining capacity online, split evenly between the U.S. and Canadian markets. 1,700,000 MT has been planned, with 500,000 MT in the more mature U.S. market and 1,200,000 MT in the quickly growing Canadian market.

Capacity will be brought online gradually as construction is completed in phases. This makes for an easier-to-manage scaling process, mitigates the risk of a price war, and enables the cash-flowing of capex for later construction phases.

INDUSTRY CONTEXT

Legacy refiners operate old refineries with higher maintenance costs, less efficient processing (batch vs. continuous), and they require immense capital expenditures to expand.

Lantic (of $RSI.TO) is spending $148 million (USD) to expand its Montreal capacity by 100,000 MT ($1,480/MT).

Sucro is building 250,000 MT in Chicago for a projected cost of $72 million ($288/MT), and they already built the original Hamilton refinery (105,000 MT) for $200/MT.

THE UNITED STATES

ASR Group is the largest refiner in North America from decades of gobbling up smaller competitors. ASR has about 6 million MT of refining capacity, with Domino refineries in Yonkers, NY (470,000 MT) and Baltimore, MD (800,000 MT) making up their Northeast U.S. capacity of 1,270,000 MT.

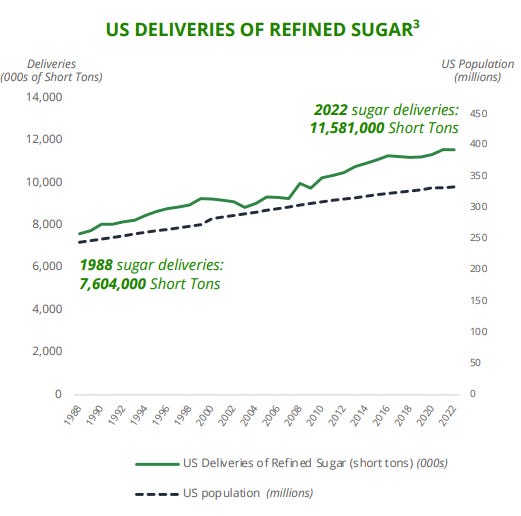

The need for refined sugar continues to grow slowly and steadily in the U.S., and refining capacity has not kept up. Refined imports are needed to make up the difference.

The USDA’s September 2024 Sugar Import and Re-Export Report projects 232,000 MT of refined sugar imports (not for re-export) for FY2025. Extrapolating the past 10 months of high-duty refined imports forward predicts 230,000 MT annually. Those totals combine for 462,000 MT of refined sugar imports to the U.S. annually, as defined by the USDA.

Between the Lackawanna and Chicago facilities, Sucro is planning 500,000 MT of capacity, proportional to the deficit. Additionally, Sucro’s ability to refine organically or conventionally with a wide variety of grain sizes and grades will enable them to take market share from competitors whose customers want a more flexible supplier at a lower price point. Because of Sucro’s unique capabilities, customers should be sticky as Sucro carves out a niche in the supply chain. There is room in the U.S. market for this expansion, and the regulatory environment discourages imports—the USDA should be supportive of more domestic capacity.

CANADA

Sucro’s micro-refinery in Hamilton (commissioned in 2019) was the first refinery successfully brought online in Canada since 1958. BMA Group was responsible for the project, and following that success, Sucro is continuing to work with BMA on further expansions (check out their tech, it’s pretty cool).

The Canadian market is effectively a duopoly, dominated by Rogers ($RSI.TO) and Redpath (owned by ASR Group). Sucro’s entry into the market is a welcome reintroduction of competition for customers.

Canada represents most of the growth for the industry in North America because of a recent acceleration in sugar-containing products being manufactured for export to the United States. These manufacturers need more domestically refined sugar, as Canada tightly controls imports to support domestic refiners. To meet this need, Sucro is building its 1,000,000 MT facility on the docks in Hamilton, ON.

THE CUSTOMERS

Sucro currently serves 10 of the largest 15 sugar-using food and beverage companies in North America with no single customer representing more than 6.3% of revenue. These are the same customers the other refiners are supplying. If Sucro can better provide for customer needs with more variety at a lower cost and better trade flow, they can take share. Sucro aims to be known as “the refiner who is working closely with customers to address their needs” (start 30:10).

The way the forward contracts work, Sucro has visibility into demand for the upcoming year. They get commitments ahead of time, which will allow them to scale up or down production as needed. So far, demand has been high for each of their capacity expansions in the U.S. and Canada.

IF THEY EXECUTE

I am confident the valuation will look like this when they achieve 1,000,000 MT of production. Perhaps it takes them a couple years longer or costs them a couple hundred million dollars more. Still, the basic arc remains the same and returns should be positive as long as no tail risks materialize.

Q&A

Why did they IPO a small proportion of the company?

The 2022 IPO was done to help fund the Hamilton facility. They raised $11 million. They also raised $8 million in a private placement in 2021.

Will they need to raise more equity?

No, likely not. Management is proud of its history of discipline around issuance and has stated there will not be needless dilution. However, if cost overruns become a constant problem in construction and credit lines are tapped to the greatest extent possible, I could see an equity raise being possible in the mid-distant future. All the projects are fully funded today through their first phases, out to 2026/27.

“Expenditures related to the construction of our Chicago and Hamilton refineries will be funded predominantly with long-term debt and, to a lesser extent, cash derived from operating activities” (Q2 ‘24 MD&A).

Recent Headline: “Sucro Limited Secures $325 Million Credit Facility Led by Rabobank”

Does raw sugar price volatility affect profitability?

Typically, no.

Liquidity in the stock is very poor. Will that get fixed?

For now, it’s probably part of why the stock is priced the way it is, so it can be viewed as contributing to the opportunity here. But yes, management is aware of the problem and has recently hinted at getting it fixed. Chairman of the Board, Don Hill has mentioned in the past that a Nasdaq listing is “absolutely on our radar” (start 33:30).

In his most recent interview, he said the lack of trading liquidity is “an issue we’re going to resolve over the next little while and it’s something we’re obviously very highly confident about.” These comments, combined with the quality and depth of the company’s disclosures, leads me to believe an uplisting is in the company’s future, if not imminent. If his most recent comments were not about a new listing, perhaps a stock split could be a more immediate step.

PRIMARY RISKS

Construction cost and time overruns lead to greater-than-expected financing needs and delayed cash flows.

Regulatory “black swans” like NAFTA being canceled, the USDA changing sugar policy, or the USDA revoking Sucro’s refiner’s license.

A secular downtrend in the consumption of products containing sugar.

Refined sugar price wars in the U.S. and/or Canada due to capacity expansion.

CONCLUSION

Sucro is an emerging refiner doing things differently than its incumbent competitors. They are building capacity faster and cheaper than competitors and employing technology that enables more flexible production at lower prices. They are poised to take market share and close the supply-demand deficit by serving as the choice sugar supplier for food and beverage producers who require more tailored service. If management can execute on the vision they have put forward, Sucro should be worth 5x its current valuation in 5 years, in my estimation.

ADDENDUM

Before you make any decisions, listen to any of the numerous presentations Don Hill (Chairman of the BoD) has given on YouTube (they’re all pretty much the same really) and read Sucro’s Annual Information Form (SEDAR links often break, you may have to find it yourself on SEDAR). Their disclosures are far more comprehensive than I can achieve in this introductory pitch, and they do a fantastic job (which is a green flag itself).

Thank you for reading.

Please subscribe and share this post if you feel your time was well spent here.

Until next time.

I have a material investment in Sucro Ltd. I intend to hold for multiple years, but my positioning may change at any time and without notice.

I do not work for the company in any capacity.

I write for informational purposes only; nothing written or said should be misconstrued as financial advice.

well written!